An interview with contributor Lorum Ipsum

Lorum Ipsum has been working in the Economics and Energy Industry for over 20 years. Lorum talked to Tochnyi about the current state of the Russian oil industry in light of recent Ukrainian strikes on Russian oil terminals.

The Russian economy in 2022

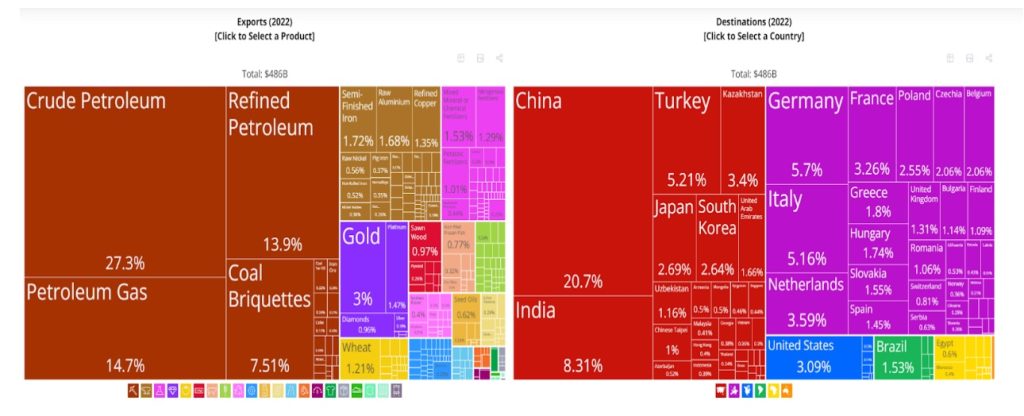

To begin with, we’re going to take a step back to view what the Russian economy looked like according to data reported from 2022; both in terms of exports and in terms of export destinations. The chart here shows how heavily concentrated these are, not just around energy or just on Crude, but also on energy more broadly.

The chart depicts Crude Petroleum and Petroleum Gas at 27% and 15% respectively, Refined Petroleum at 14%, Coal Briquettes at 7.5%, with this being just a small portion of the entire coal being extracted. So, we are looking at roughly 60% that is objectively tangible for energy industry extraction. If you were to go through that graph and examine the other extractive industries (gold, wheat, etc) – You can see that the overwhelming majority of products here compose an extractive industry sold into the global market.

Obviously, this is the 2022 data, so take it with a grain of salt, but these are leading indicators – This is showing what was delivered in 2022, not what was ordered in 2022. The future forward projection of this data would obviously be much more skeptical. The next slide is more useful in this regard.

Natural Gas – the core of the Russian economic model

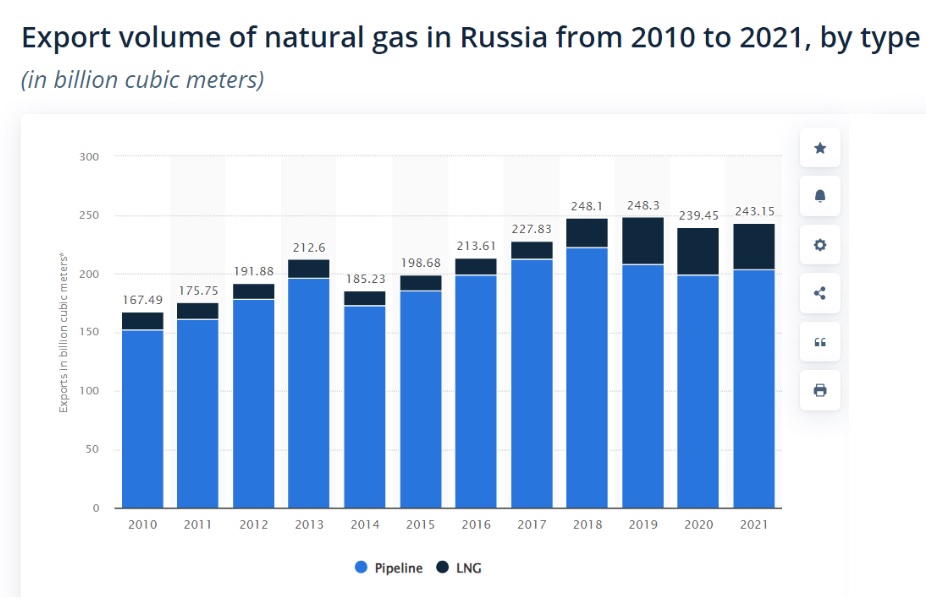

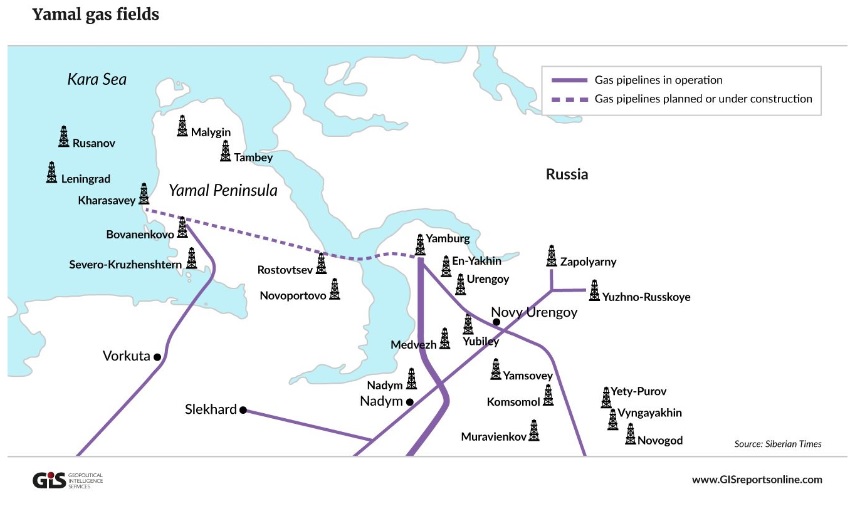

The slide here depicts solely natural gas exports. Natural Gas, keep in mind, is the core of the Russian economic model. The Yamal gas fields were feeding the European natural gas market – Germany, France, Poland, Slovakia, etc pre-war. The chart above is illustrative of this. LNG accounts for a tiny percentage in this regard. LNG just so you know, I apologize if I’m over explaining here, LNG is liquefied natural gas. It has a very complex transfer system. You need to take gas from specific pipelines. You need to put it on specific ships through specific terminals. Those ships then need to go to specific ports on the way to their destination and these have to have specific gasification terminals – only then can Russia actually take that gas to market.

Consequently, Natural Gas is not something that can be easily built out, but even in the run up to 2021, as you see that dark blue part of the chart expand, that is a very small percentage of their overall market. Most of that light blue, the overwhelming majority of that light blue, is what was sent by Gazprom from Yamal to Western Europe in one way or another, whether it was through the overland pipelines, through Poland, Belarus and Ukraine, or whether it was through the undersea pipelines from Nord Stream 1 and Nord Stream 2. Obviously those two pipelines that I just mentioned were shut down.

Nord Stream 1 was shut down by Russia several months prior to its explosion, and Nord Stream 2 was never operational. But, to be clear, the main delta in terms of Russia’s natural gas energy export capacity was around LNG.

The Russian oil terminals hit by Ukrainian long range strikes

The following graphic depicts the sites that have been hit by Ukrainian strikes since the start of the 2022 Russian invasion of Ukraine. To be clear, these sites are not necessarily offline at this moment. Nevertheless, if you look around St Petersburg to the Kerch Peninsula, those site clusters comprise the main export capacity for Russian LNG. Hitting those – and we don’t know what the exact consequences have been to date – but hitting those would deal a critical blow to Russia’s ability to export both LNG and the much more fungible Crude oil.

If we look at the middle section of this graphic, from Belgorod to Kursk and all the way around to Saratov and all the way up to Nizhny Novgorod, and then back around down towards Moscow – That’s all Russia’s refining capacity; the ability of Russia to produce gasoline, jet fuel and all other variations of jet fuel.

There are two separate questions that arise here. One is over the ability of Russia to make money by exporting LNG and crude oil and refined products – and that’s represented around St Petersburg and around Rostov and around Kerch. The second is Russia’s ability to provide refined products for the people who need it, whether those be civilians or whether it is their military. This relates to the middle of this chart, from Belgorod, Kursk east to Saratov to Nizhny Novgorod and around towards Moscow.

We don’t know exactly what damage was done to each facility. These facilities are well designed, to be clear. They are not ‘single point of failure’ facilities. Just because a facility was hit does not mean that it was taken off-line, or that its capacity is necessarily discounted from the overall equation that you’re calculating, whether this relates to exports, or domestic production.

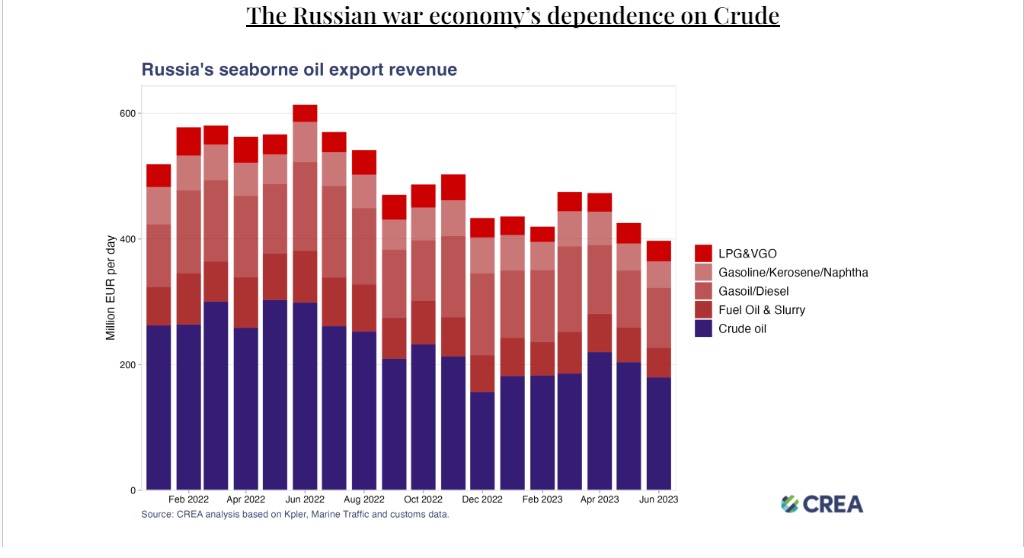

In this next slide we can see a breakdown of the refining graph for Russia. As you can see, the majority of what Russia produces and brings to market is Crude – unrefined Crude oil. The second biggest component of that is either Gasoline or Diesel. So, the more exotic, refined products have always been marginal for them, but those are the ones they might need in terms of a domestic supply emergency.

There are two questions that arise here. One, how does this affect the Russian economy long term? Well, you can see the answer to this question within the purple shading of this graph right here, and a bit within the very dark red shades also. Two, what does this mean for the Russian ability to keep its mobilized forces in the field and to also keep its civilians able to travel from A to B?

The answer to this second question is seen within the three middle shades of red to a lesser degree. When you factor in aircraft fuel requirements, it gets a bit more complicated but this is a rough summation.

Assessing Russia’s Pipeline Vulnerabilities

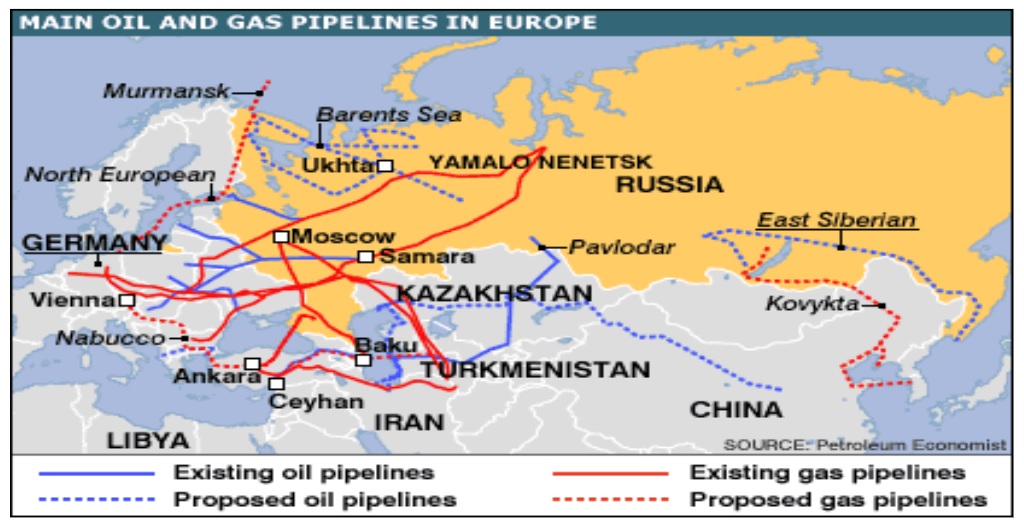

We can see on this next graph that Yamal is the major nexus of Gazprom’s Western Siberian gas fields. You see those two red lines – where do they point? They lead into Germany. There is also a potential line that goes into Vienna, but, crucially, there is no connection between those gas fields to any other LNG point, aside from St Petersburg, which as we discussed previously has been at least threatened (if not taken off-line) and there’s no through point to China. If you look on the right side of that image, the eastern Siberian pipelines, that’s ‘Power of Siberia 1’.

The goal that Russia has is to connect to Yamal, which is in the top center of this image, to the Eastern Siberian network, which is in the right side of this image. That’s ‘Power of Siberia 2’. China has made very clear they have no intention of approving this pipeline. That pipeline will take ten years to make and at least half a trillion in USD, maybe more, maybe closer to a trillion.

Thus, Russia’s ability to sell their gas, but also Gazprom’s ability to sell the gas that they were selling routinely and at a very good profit to Western Europe after 2022 from Yamal – is entirely compromised for the next decade. This is not something that they can solve within the next decade, even if they have massive capital expenditure – and capital expenditure is not easy to come by.

Priority Target – Yamal

Pictured is Yamal and its multiple different facilities. One question that I repeatedly get asked is“if you could hit anywhere in Russia, where would you hit?” The only answer to this question is Yamal. There are crucial oil facilities there – exceptionally large refineries, extraction points, through points, terminals, storage points.

If Ukraine hit Yamal, if they could ‘square delete’ what’s on the map right here, that would bankrupt Gazprom.

Yamal is obviously beyond the supposedly established range of what Ukraine can currently hit.

But:

If Ukraine could hit Yamal, this threat alone would have the potential to cripple Russia’s exports of natural gas going forward, both LNG in the near term and via proposed pipelines such as Power of Sibera 2 in the longer term.

If Ukraine could hit Yamal it would be a disaster for the Russian energy industry, which is the cornerstone of the Russian war economy.

Yamal was Russia’s main source of funding – but is still the main source for its industry.

If Ukraine could pick one target to prioritize above all others, Yamal would be that target.