Since our last research report, we have broadened further our search for the factories supporting the Russian war machine. While media attention has thus far been given to well-known factories producing tanks, infantry fighting vehicles, rockets and other munitions, articles on this topic have not yet uncovered the network of industries behind many of these production lines. In many cases, these factories are system integration facilities that receive critical components from smaller factories or research centres. This includes not only specialised components but also structural parts such as thick plates of steel or aluminium, shafts, disks, preforms, and axles. These components require a metallurgical plant for forging and machining, as well as a sophisticated foundry to produce the required quantities of steel.

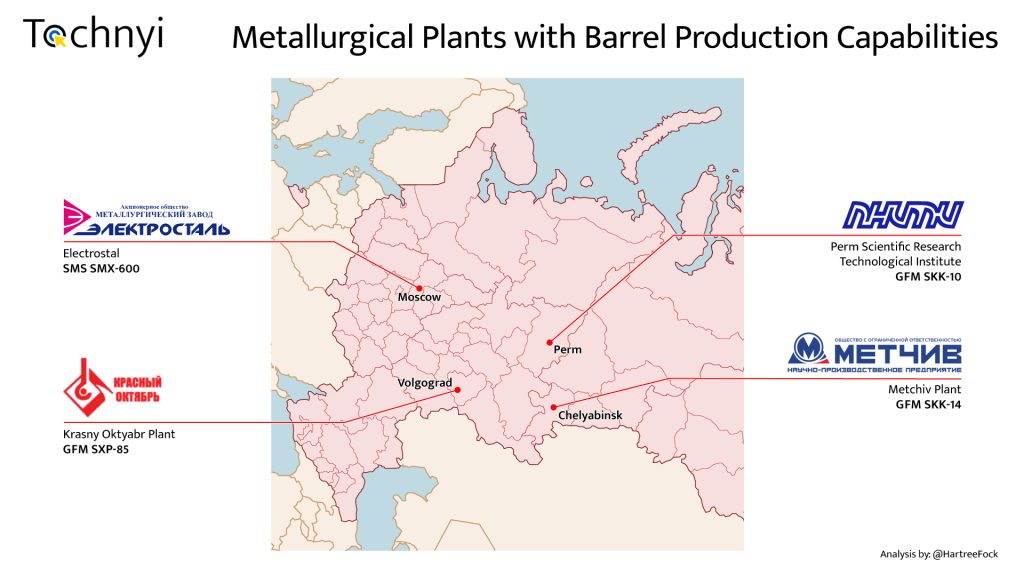

In this investigation, we identified several metallurgical plants capable of producing various components, which ultimately facilitate and sustain the Russian war machine. Our primary focus was on barrel production, as this has piqued the interest of the research community. However, our analysis has revealed additional capabilities and connections between different Russian plants and defence factories. During our current investigation, 4 production or research facilities in the Russian defence industry have proved significant. The most prominent of these are Electrostal, which has already been covered in one of our previous articles [1], the Metchiv Plant, the Perm Scientific Research Technological Institute, and last but not least, the JSC Volgograd Metallurgical Plant Krasny Oktyabr, also known as the Red October metallurgical plant. In this article, we will focus on the latter.

Krasny Oktyabr is situated in Volgograd, formerly Stalingrad. It has a history etched into the annals of the Soviet WW2 narrative, even though the factory itself is not as old as Elestrostal, owing to the fact that the Red October plant was destroyed during the siege of Stalingrad. The JSC Volgograd Metallurgical Plant Krasny Oktyab, is known to be one of the largest manufacturers of rolled metal products of specialized steel grades in Russia. By examining the history of the plant it is possible to identify the production of hot rolled steel sheet metal, in different thicknesses, calibrated steel, cutting steel metal, special steels and pipe blanks.

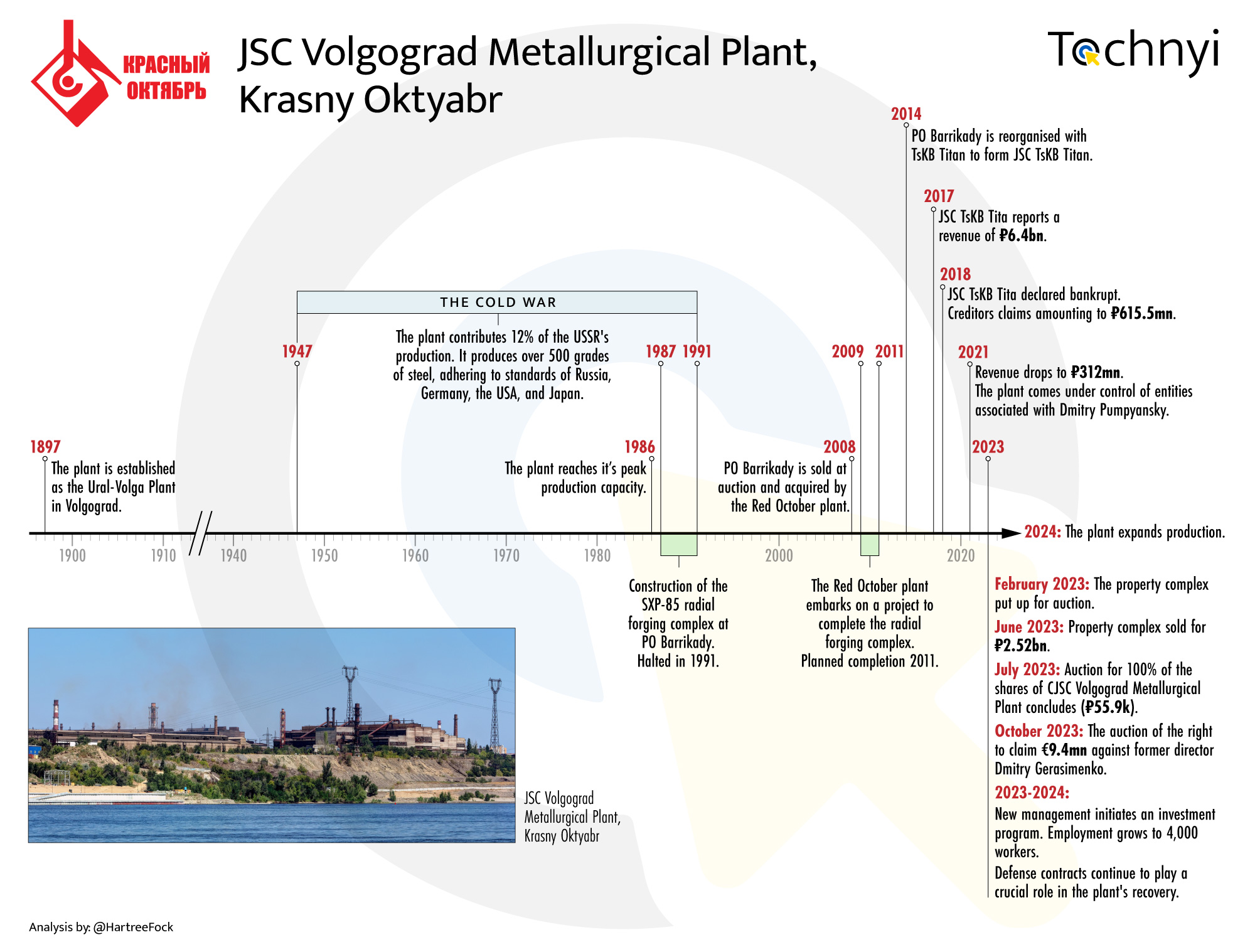

The plant was active during the Cold War and by 1986 it had a production capacity of 2 million tons of steel per year, with 1.5 million tons of rolled products, accounting for 12% of the entire USSR’s production of high-quality steel output, including 14% stainless steel production and 52% of electroslag remelting steel, respectively. This plant has proved capable of producing a large range of grades, over 500 in total, all manufactured according to present Russian Federation standards, as well as those aligned with Germany, the USA, and Japan. However, the Red October plant entered our radar not for its steel production, but for a project of expansion it began in 2009. In that year, the Red October plant was visited by representatives of both Russian and foreign companies specializing in the design, manufacture and installation of special metallurgical equipment. These companies presented their feasibility studies and commercial proposals for participation in a project to build the SXP-85 radial forging complex (PO Barrikady) and modernize the Krasny Oktyabr plant overall [2].

The radial forging machine in question is the same present within a CIA report [3], in which, at the time of its publication, no information was made available regarding the machine’s location. Nevertheless, we now know that the completion of the construction of the radial forging complex, which was started at PO Barrikady in 1987, was never concluded due to the sudden halt in production caused by the collapse of the Soviet Union. From the documents which emerged concerning this developmental cessation in 1991, we learn the following:

“Commissioning of the radial forging complex in modern conditions will allow it to manufacture components for military equipment and weapons, as well as civilian products.”

At the aforementioned 2009 meeting at the Red October plant, it transpires that Western companies were both involved and in attendance. Some of these companies had even been working with the Red October plant following Crimea’s annexation by Russia in 2014, as well as prior to the 24th February 2022, a period when Russian preparations for its full-scale invasion of Ukraine saw the production output of the Red October plant supply the invading Russian forces which went on to perpetrate the invasion of Ukraine. The companies in question were Danieli (Italy), ALTA (Czech Republic), Siemens-VAI (Germany) and MTE (Russia). At the time, the cost of these endeavours was covered via special credit funds made available by Russian banks.

For the renovation and completion of the Radial Forging Machine, approximately 40 million euros were dedicated. But this, it transpired, was not the only work performed at the Barrikady and Red October plants. The entire forging complex, which included a DEVI-MAKI press, heat treatment equipment, and machines for mechanical processing of forgings, was planned for a final modernization plan costing over 120 million euros, with a deadline of completion in 2011. Based on our information the press installation and commissioning, at least, was done by Danieli Group [4]. At the time, the ties between PO Barrikady and Red October were firmly established, as were those with the Russian defence industry. PO Barrikady had barely survived the economic downturn of post-Soviet Union Russia, thanks to the sale of Shtil anti-aircraft missile systems mainly sold to India and China. However, in 2008, after years of mismanagement and significant debt, the plant was sold at auction and was acquired by the Red October plant. Little changed in terms of production, giving the Red October plant a solid position in the defence market. On October 1st 2014, PO Barrikady was then merged with another company, TsKB Titan. Both organisations maintained the working practices in place prior to the merger but legally became a single entity known as JSC TsKB Titan. PO Barricady was, and is still today, as JSC TsKB Titan, at the forefront of the production of military equipment for the Russian armed forces, in particular the ground equipment units for Iskander-E and Topol-M missile complex, the self-propelled howitzer system 2S19 MSTA-S and production of T72 and T80 main guns. The factory also produces the 152 mm Howitzer 2A65 MSTA-B barrel.

In the post-Soviet period, after corporatization, the owners of the Red October changed hands several times. In 2013, Dmitry Gerasimenko became its owner, who subsequently initiated the bankruptcy procedure of the enterprise, buying out part of the enterprise’s debts through shell companies. In 2018, Krasny Oktyabr was declared bankrupt, and the enterprise’s operations were suspended. After the intervention of the regional administration, the plant received a large defense order and resumed steel production in 2019. In 2021, the plant came under the control of the structure of billionaire Dmitry Pumpyansky. The plant’s physical assets were similarly devalued, with the property complex, initially valued at 8.39 billion rubles, being sold for just 2.52 billion rubles in June of 2023. Additionally, the shares of the plant were auctioned for a mere 55.9 thousand rubles in July 2023, a stark highlighting of the plant’s financial woes.

The plant’s recent resurgence can be attributed not only to strategic investments in its modernization, including workforce expansion but also to its involvement in defence contracts, which have played a critical role in stabilizing and reviving its operations [5]. The Russian defence industry has long been a cornerstone of Russia’s economy, and Krasny Oktyabr’s ability to secure contracts for the production of specialised steel for military applications has significantly contributed to its recovery. These contracts have provided the plant with a stable revenue stream and the means to invest in the technologies and equipment essential for producing the high-grade steel required in defence manufacturing. As part of its revival, the plant has embarked on a major investment program, including the commissioning of four new steel-smelting furnaces by 2024. This move is aimed at increasing the production of stainless steel, which is vital for both civilian and military applications. The growth in employment—from 3,200 employees in early 2022 to 4,000 by mid-2023—further underscores the plant’s recovery and its strategic importance to Russia’s defence sector. In summary, JSC Volgograd Metallurgical Plant Krasny Oktyabr has navigated a challenging period of financial decline and bankruptcy, but its involvement in defence contracts has been pivotal to its recovery. Alongside modernization efforts and improved labour conditions, these contracts have provided the financial stability necessary for the plant to reclaim its position as a leader in Russia’s metallurgical industry. The plant’s connection to the defence industry is shown by its direct support to PO Barricady, the current JSC TsKB Titan plants, and its past activity. Since 2012, the Red October plant has provided specialised steel (EP-817Sh) to RSC MiG factories, and has also collaborated with Uralvagonzavod’s production line. Uralvagonzavod had actively sought its own sheet rolling production, which was upgraded in 2012.

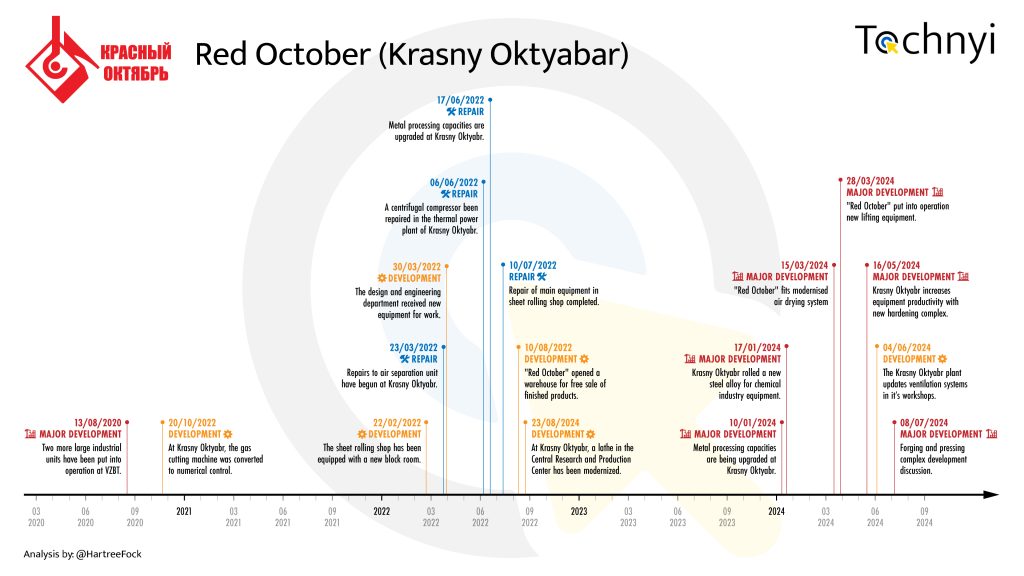

This was not the only type of improvement the plant had undergone since its initial sluggish transition from the Soviet era. We have traced back to 2020 the plant’s development and repairs, many of them made public by its own press office. What emerges is a chronology that coincides with the Red October plant’s historic financial struggles and a period of large repair and smaller-scale development commencing mid-2022 and lasting until 2023. However, as this timeline chronicles, the plant’s major developmental plans kicked off drastically in early 2024 and are still in progress today. This is particularly significant since sanctions on Russian exports were intended to limit plants like the Red October’s access to large capital for improvement and expansion, with any such developments requiring a secure income guarantee from either governmental budgets or other enterprises involved in Russian defence production.

Red October’s latest expansion plan involves upgrading its forging capabilities through the creation of a new ‘forging and forming’ area. The entire topographical map of the plant is shown below, with the area in red illustrating where the planned refurbishment will take place. Currently, the proposed area for development merely resembles a parking lot, located in a decrepit area of the factory. Red October’s emerging plans, however, include the installation of a large forging press of up to 3100 tons, along with several other specialised thermal instruments: a heating furnace capable of operating up to 1110°C with dimensions of 3.5×14.5m, thermal chambers for rolled components measuring 3.5x10m, quenching tanks for both polymer and water sized at 3x24m, and load lifting capabilities of up to 50 tons, with a maximum height of 16.25 metres and a span length of 24 metres. The press itself will be serviced by a lifting rotating table and a forging manipulator – both capable of supporting both large ingots and forged shapes up to 30 tons. In addition, there will be a series of continuous gas furnaces capable of reaching operating temperatures up to 1300°C. These are just a few of the developments the plant has planned; designed to enable the Red October plant to be even more capable of supplying the raw materials needed to produce key components for the Russian defence industry.

In conclusion, this investigation has shown how the Red October plant has exemplified the intricate relationship held between Russia’s industrial capabilities and its supporters, and the Russian armed forces. The plant’s recent expansion plans, including the upgrading of its forging capabilities, illustrate the plant’s ongoing evolution as a pivotal supplier of specialised steel and components essential for munitions and related defence production within Russia. These upgrades have been facilitated by the support provided to the Red October plant by Western companies. Krasny Oktyabr remains a key installation in Russia’s defence manufacturing strategy. The plant’s ongoing contribution to the Russian war machine, the perpetration of the invasion of Ukraine, and the resulting seismic shift in geopolitical security, is significant.

References

[1] https://tochnyi.info/2024/07/russian-hidden-factories-the-giants-clay-feet/

[2] http://www.metalindex.ru/news/2009/07/13/news_17772.html

[3] https://www.cia.gov/readingroom/docs/doc_0000496800.pdf

[4] https://www.volgograd.kp.ru/daily/26451/3321654/

[5] https://mil.in.ua/en/news/italian-danieli-group-continues-cooperation-with-russian-metal-industries/