Since the start of the illegal invasion of Ukraine in 2022, Russia has been strengthening its military industry and increasing its military budget [1] by an outstanding 30% of its entire budget. This increase in spending has been accompanied by claims from Vladimir Putin [2] that around 520,000 jobs have been created in the sector. However, these figures remain unverified. At the same time, it has been demonstrated that Russia is facing difficulties recruiting a skilled or employable workforce for its industrial efforts [3]. The report highlights a significant decline in the workforce’s age, with a progressive demographic crisis due to the substantial reduction in the pool of young people the industry could rely on to fulfil its needs. The report finds that despite Russia’s efforts to make these jobs more desirable by increasing salaries, the bottleneck remains due to the low number of employable people resulting from social problems and basic training issues.

To produce a large number of defence-related articles such as tanks, IFVs, and ammunition, well-established factories need to work around the clock to provide the supply chain with all of the key components needed to create a weapon system. Since the start of the war, one of the first topics of discussion when speaking about the Russian army has been its incredible reliance on artillery and the significant difference in availability of guns and ammunition compared not only to Ukraine but also to Western countries.

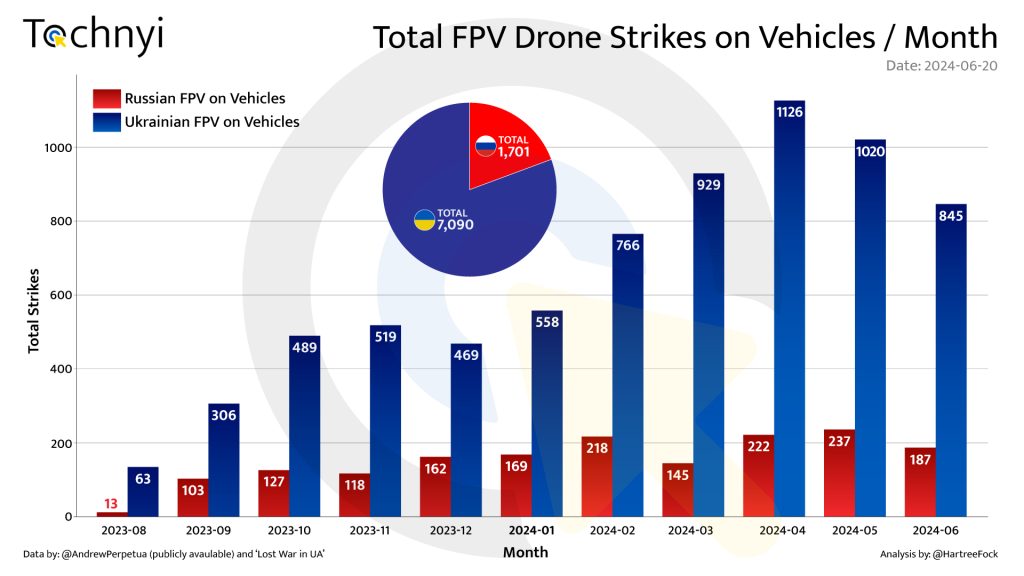

This includes multiple rocket launching systems like the BM-21 and TOS, as well as tanks and autocannon barrels. Up until now, Russia has relied on and continues to rely on stocks from reserve and Soviet-era equipment, which, despite ageing, have kept the Russian war machine afloat. The current level of attrition is consistently high, largely due to the use of relatively inexpensive but effective drones such as FPV heavy bombers and kamikaze as shown in Figure 1. To illustrate the extent of attrition, a plot based on public data from Andrew Perpetua’s research and the Lost War in UA report shows a staggering number of observed strikes on vehicles, with a peak of 1126 observed in April.

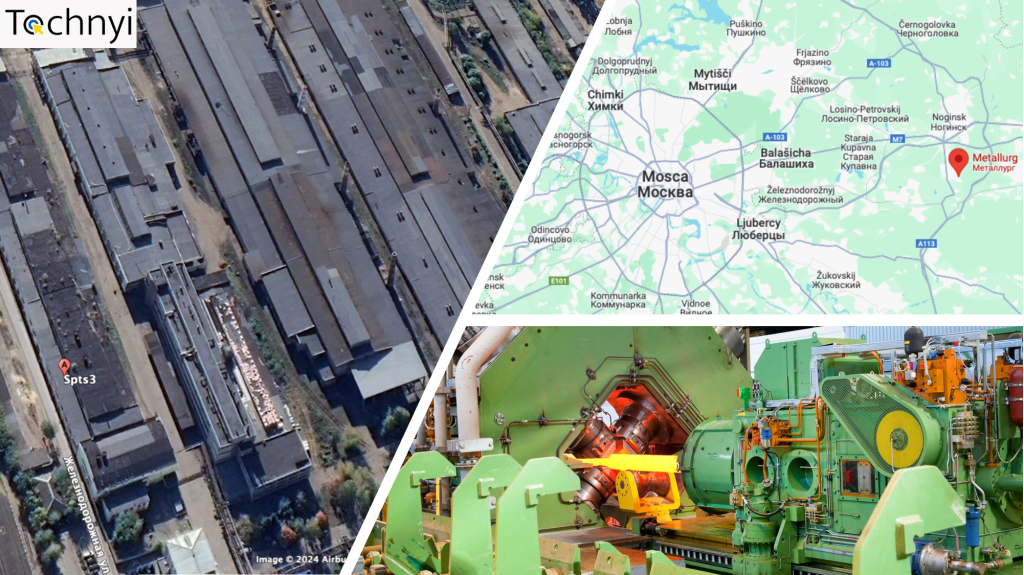

All of these factors have put additional pressure on the logistical operations of the Russian army. They are now tasked with replacing damaged and destroyed equipment. Additionally, the Russian Summer Offensive put additional pressure on various weapon systems, particularly artillery, which faced a ratio of 7:1 against the Ukrainian army at the peak of the offensive [4]. Many analysts are questioning how long Russia can sustain its current level of production and whether it can replace all the barrels that are consumed. An article from The Economist [5] expresses doubt about Russia’s ability to produce enough barrels, estimating that only 100-200 are produced annually. However, this assessment is based on the assumption that Russia has not acquired any new machines and still relies on GFM radial forging machines obtained between 1974 and 1980. Moreover, this unverified information is also based on the belief that, due to the ageing of the machines, the impact of sanctions, and the natural obsolescence of these systems, the Russians are unable to achieve the production levels predicted by the CIA in their report [6], which estimated 730,000 for small bore barrels (small firearms), 200,000 for medium (autocannons and medium mortars), and 14,000 for large bores (artillery and tanks). However, Russia does have new radial forging capabilities (Figure 2.) in the production shop of the JSC Electrostal Metallurgical Plant. This plant is not new, it was already known to the CIA for its involvement in purchasing GFM equipment. Indeed, Electrostal acquired 2 SXP 55 radial forming machines between 1975 and 1977 [6].

This factory, close to Moscow, looks like it has been disregarded by all the investigations, but it has been one of the most modernised by Western companies in particular Germany, Netherlands and the US. SMS Group, ALD, ABP, Siempelkamp and GLAMA USA 2011 (Figure 3.) contributed actively to the full modernisation of the plant, installing a series of new forging presses, in particular, a new SMX 600 radial forging press and also modernised a new vacuum arc furnace, vacuum induction and electro slag furnaces and two-crucible open induction furnaces. This alone represents a significant leap for an ageing plant, particularly concerning considering the development started around 2011 and took full speed after 2014 ending in 2018 [7].

Russia has contracted SMS Group to design and manufacture a customised version of its SMX 600 radial forging press. This press has impressive capabilities, including a maximum press force that ranks among some of the highest, allowing it to work with very special high-strength alloys. It also features a substantial maximum tool opening of 600 mm, providing great adaptability. The only potential limitation, at least on paper, is the maximum weight of the starting ingot, typically set at 2.5 tons due to manipulator design. However, this figure can be deceiving for two reasons. Firstly, even a fully assembled barrel, such as the M199, weighs around 1,800 kg [8], which comfortably falls within the machine’s capabilities. Secondly, machines are usually designed with significant safety margins, allowing for the use of higher masses, albeit causing more wear to the components and slightly increasing production time. In addition, this press can easily handle other types of barrels, for example, the smaller tank one or the medium bore 30mm. With an annual output of 30,000 tons, this machine can produce tens of thousands of medium-bore barrels. The SMS Group confirmed on its website that in 2018 the installed SMX 600 press capabilities had been extended to produce tubes without the need for a mandrel manipulator. Additionally, Germany collaborated with Electrostal to provide certification for the development, manufacture, and sales of steel products as well as products made from nickel alloys. The support from Western Europe today seems foolish in hindsight.

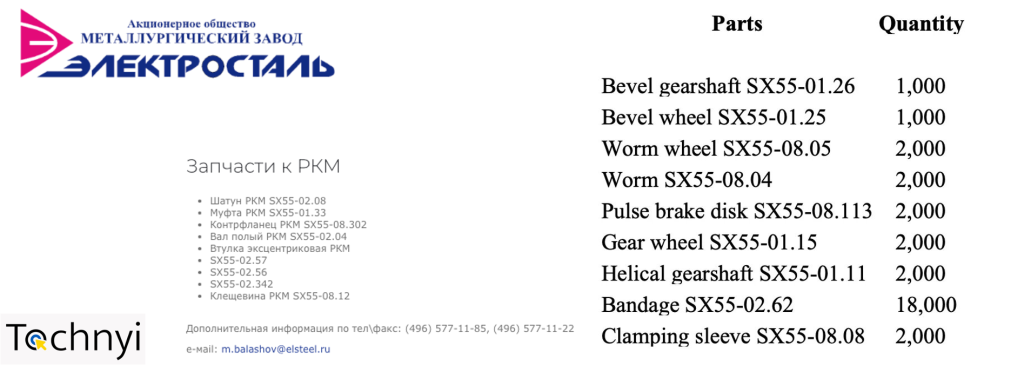

There is strong evidence of Electrostal’s involvement in manufacturing weapons due to the well-known presence of GFM SXP 55. Interestingly, this capability is not mentioned on the website, today but is present on the 2004 website accessible via Wayback Machine (https://web.archive.org/). However, a careful exploration of today’s Russian section of the website reveals an area where spare parts of GFM SPX 55 are being sold to potential buyers, as shown in the image below. These codes refer to parts for the same machine recently investigated by other OSINT analysts [9]. The presence of these parts being offered for sale is clear evidence that these machines are on site. Despite the factory’s past association with barrel manufacturing, the Russians are determined to conceal the true purpose of the factory.

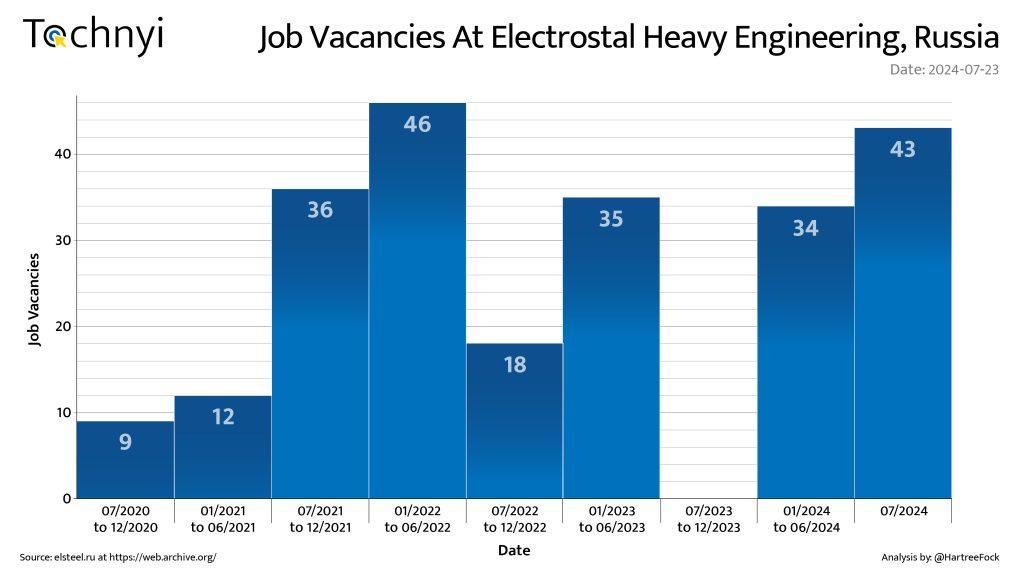

It’s important to note that this factory is involved in more than just producing barrels. It also manufactures starting geometries needed for even more complex and critical components such as shafts for turbines used in power generation, transmission parts for heavy vehicles, and wheels and tracks for tanks and IFVs. Additionally, the factory produces special materials for missile and jet engines. These diverse products require advanced capabilities, which the factory possesses, at least on paper. The use of high-quality Western manufacturing machines ensures that the factory is modern and capable. Despite this, the factory has not attracted attention from the international media, which underscores the need to recognise its capabilities. Another concerning aspect is the large number of job vacancies at the plant, including positions for engineers (specialists), a Head of the Design Bureau, and a significant number of experienced or new workers, totaling 43 open positions. This trend confirms the plant’s involvement in Russia’s war efforts.

Like many other factories in Russia, Electrostal experienced a period of recession due to the severe financial crisis after the USSR dissolved. In the 1990s, most of these factories went bankrupt, with only a few surviving without heavy subsidies from the Soviet regime. Electrostal continued to operate and shifted towards a more civilian market, particularly in aerospace, energy, and nuclear sectors, while still maintaining defense contracts. During this period, the plant mainly had revenue-generating contracts with foreign countries, as the Russian Ministry of Defense often paid little or never repaid. This is a typical aspect of the Russian defense industry, where the state offers lower prices for weapon systems to secure export contracts and offset any losses. The available job opportunities reflect the resurgence of the plant, especially in the last years of war. The data have been obtained by looking at the website, in Russian language using the Wayback Machine (https://web.archive.org/)

Based on all the evidence gathered, it is possible to conclude that Electrostal continues to play a crucial role in the Russian war machine. This is supported by different aspects. Firstly, the factory has a rich history and plenty of knowledge in the production of defense-related materials. Secondly, it possesses 3 out of the 4 known radial forging machines, two of which are known for their use in the USSR for barrel production, and one of a much more modern design with similar performance. Thirdly, the factory layout and its various capabilities in the production of specialized steel make it a very good model for centralized production of war materials. Fourth, ever since the start, and even months before the invasion, this plant has seen a large number of job positions, in line with what we have seen in Western ammunition and weapon factories, indicating an increased demand which cannot be connected to exports or internal demand of aerospace or nuclear components to the extent seen so far. Ultimately, it is evident that the Kremlin is avoiding drawing attention to this factory, which is dangerously close to Ukraine and within the range of Ukrainian drone strikes.

References

[2] https://www.themoscowtimes.com/2024/02/02/russia-has-created-520k-new-defense-jobs-putin-says-a83959

[6] https://www.cia.gov/readingroom/docs/doc_0000496800.pdf